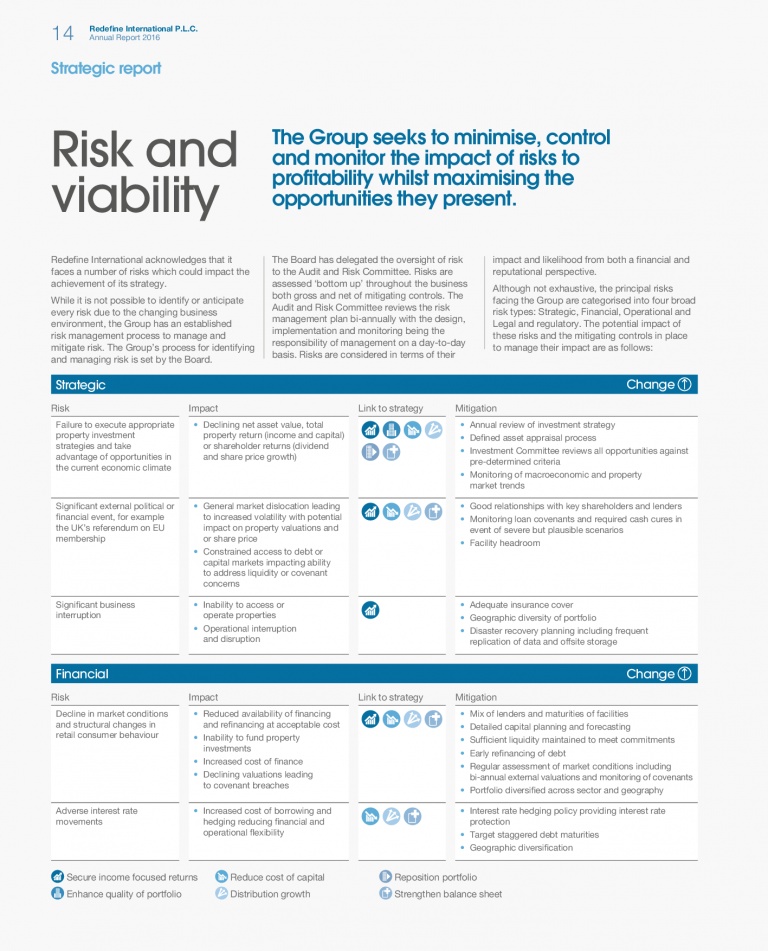

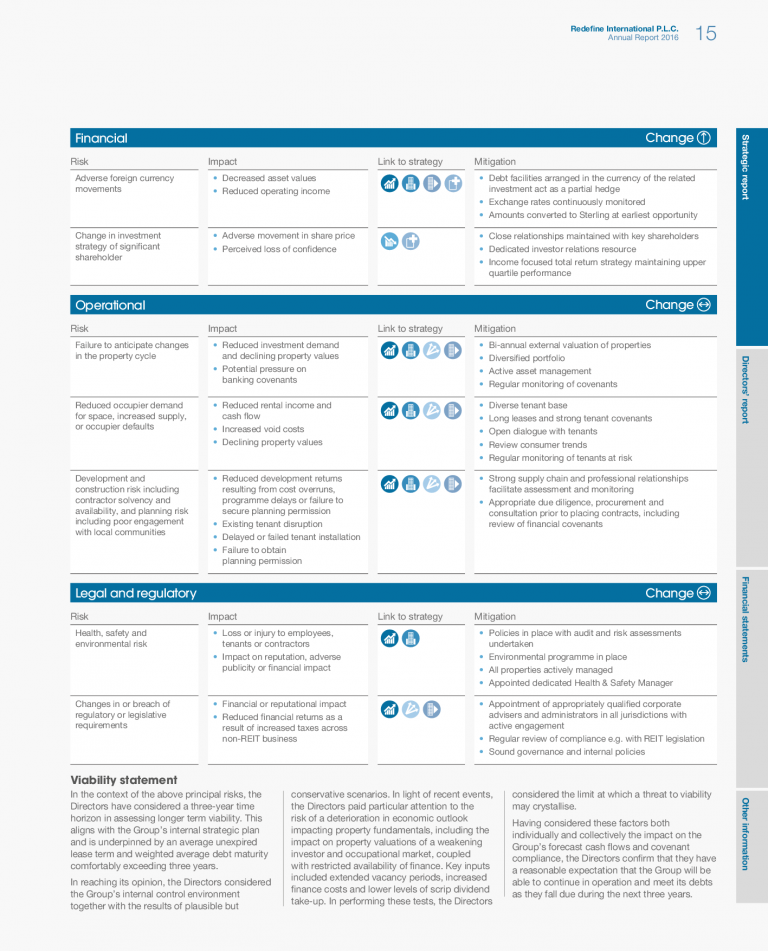

Risks and opportunities

- Value creation

- Connectivity of information

- Stakeholder relationships

Key observations:

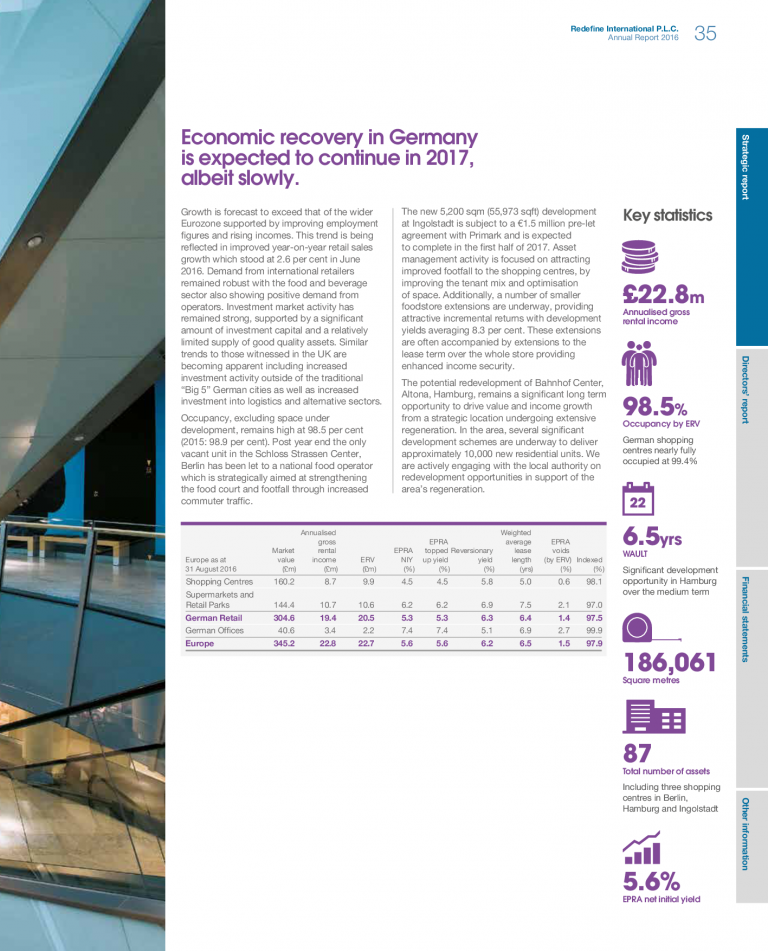

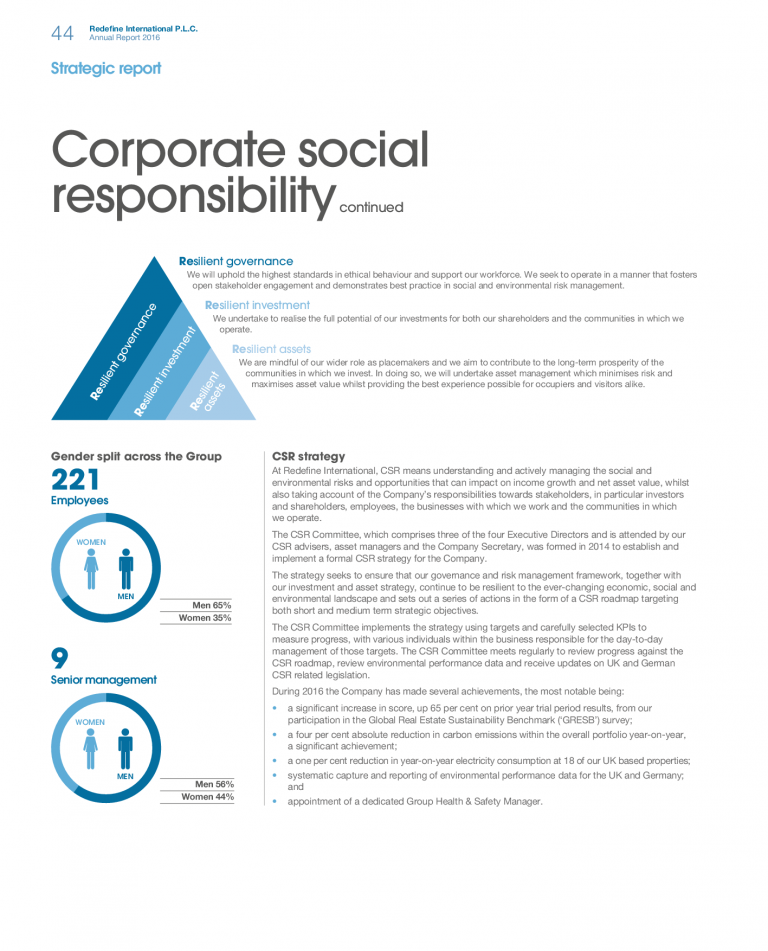

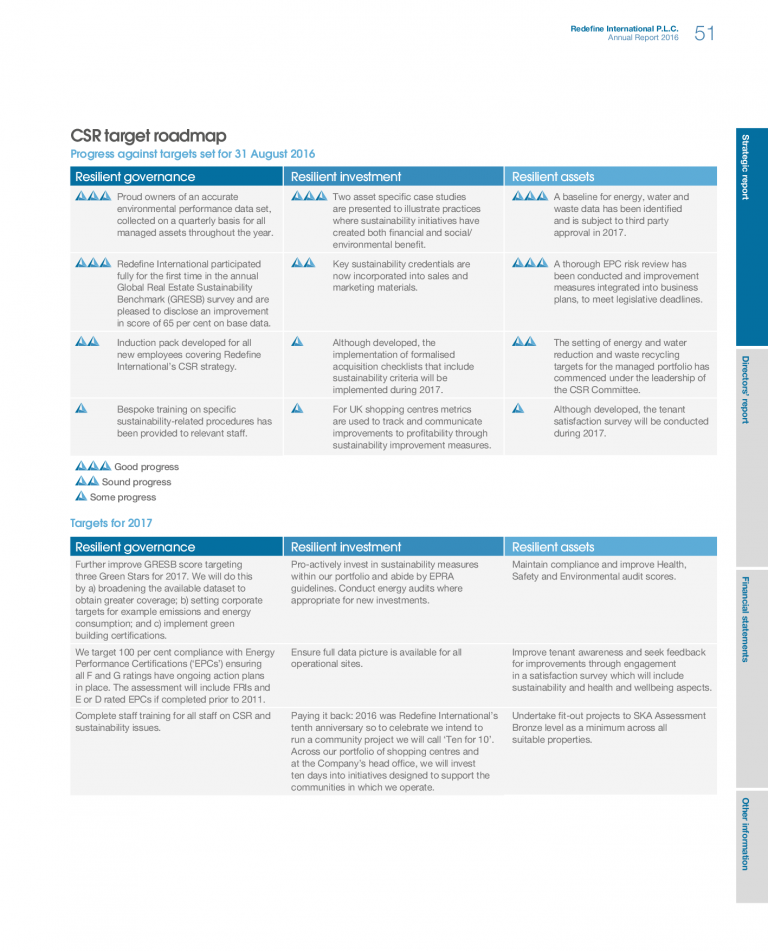

The organization’s strategic report incorporates a corporate social responsibility section (p. 42-51) outlining 3 key pillars “Resilient governance”, “Resilient investment” and “Resilient assets” which are considered central to the ability to create value for investors and key stakeholders. (<IR> Framework para 2.6: The ability of an organization to create value for itself is linked to the value it creates for others.)

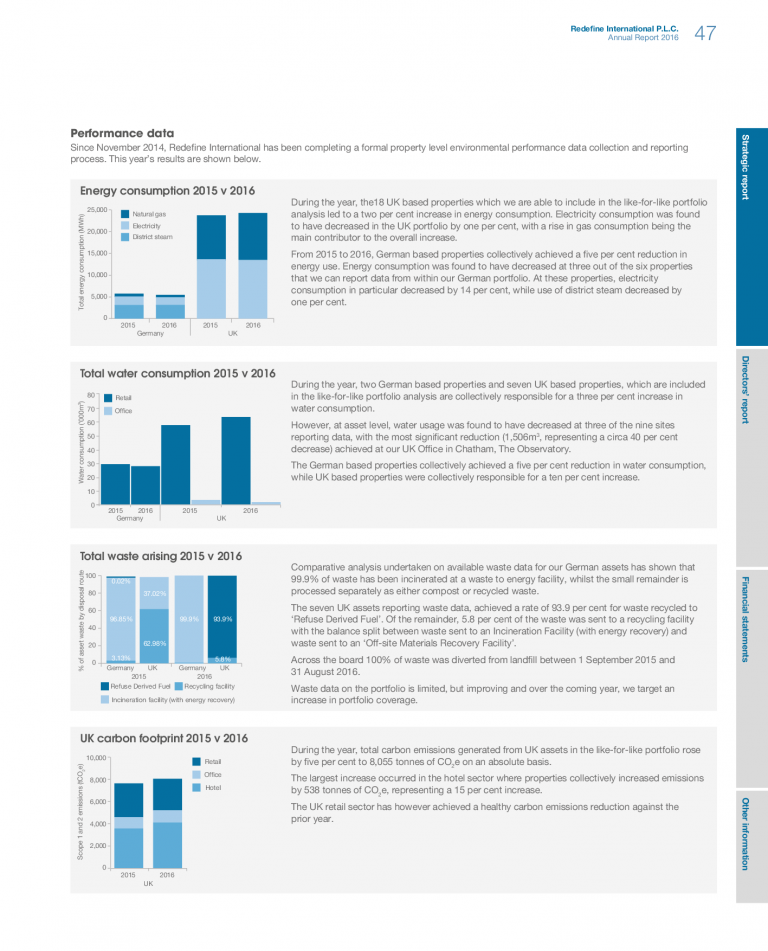

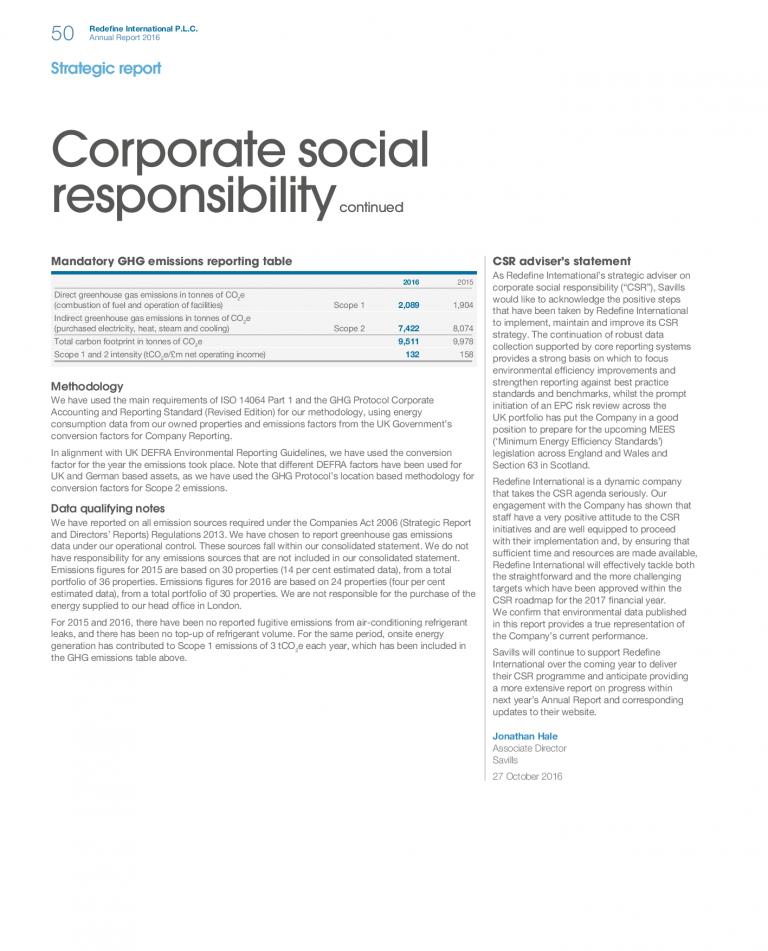

Environmental, social and governance (ESG) risks and opportunities are clearly addressed in the CSR (p. 46) and governance (p. 52-53) sections including the social and environmental performance of existing and considerations for potential assets (<IR> Framework para 4.23). The organization further benchmarks its performance against a recognized industry standard; The Global Real Estate Sustainability Benchmark (GRESB) with clear future goals (p. 51) how to achieve a better industry rating (<IR> Framework para 4.30).